More younger people are now looking to buy a home instead of renting.

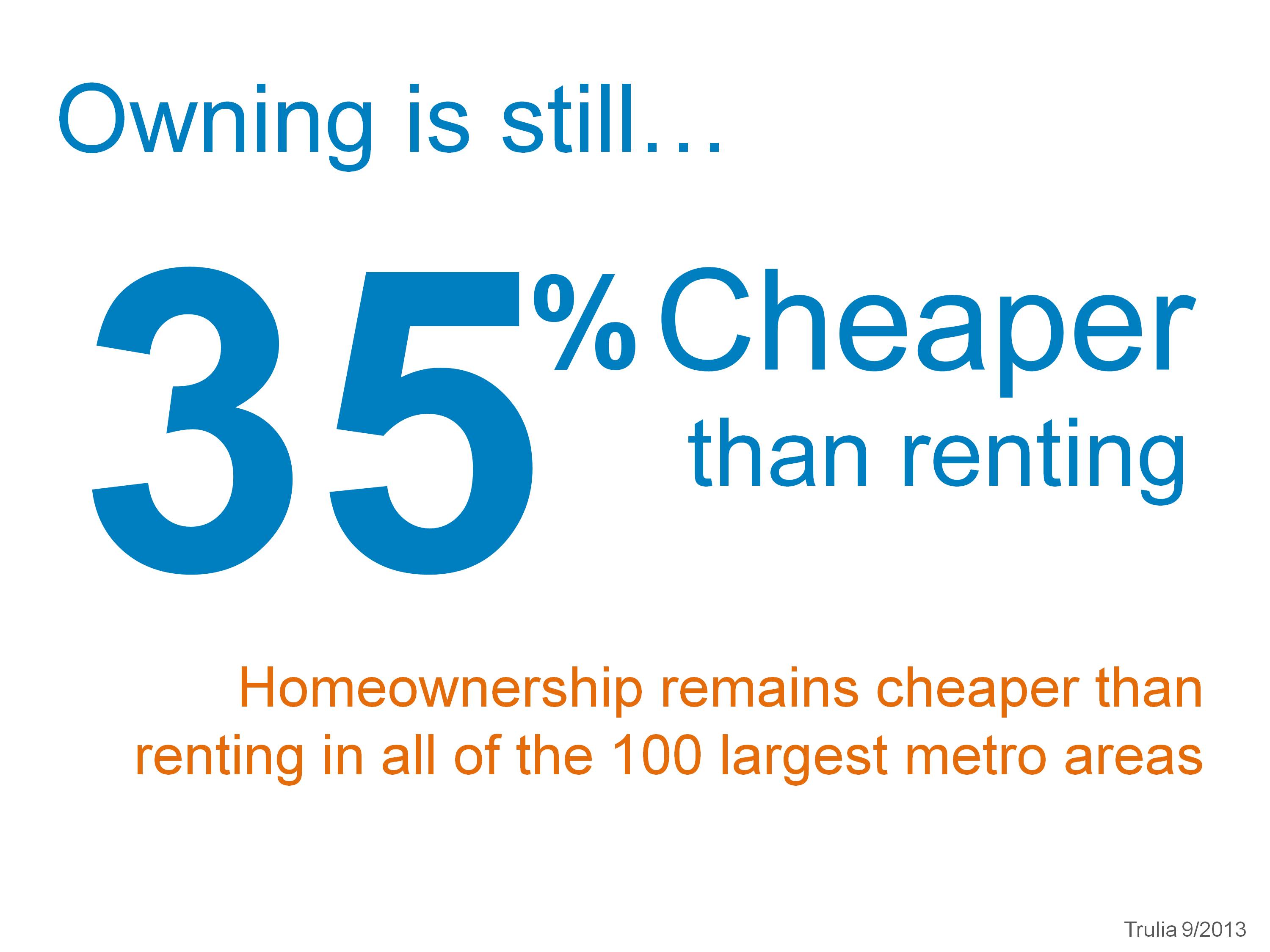

Did you know that in most areas owing a home is still less expensive than renting?

Here are a few tips to get you started if you are considering making a move to home ownership.

Ready to find a home? Renters who are ready to purchase a home are encourages by the National Association of Realtors to consider these steps first.

Pick a location. How far are you willing to commute to your place of employment? How good are the local schools, shopping centers, public transportation, senior services and other public amenities? Will your new home be next to a vacant lot or a commercial property?

Make a list. Zero in on the features you must have, would like to have, definitely don’t want and would prefer not to have. Tip: Start compiling your wish list by thinking about what you like and dislike about your current residence.

Do your homework. Recent home-sale prices, market trends, homes on the market, neighborhood statistics and information about the homebuying process is available online.

Get educated. Become empowered. Get preapproved for a mortgage. Rather than guessing or estimating how much you can afford to spend, ask a lender or mortgage broker to give you a full assessment and a letter stating how much you’re qualified to borrow. The true amount may be much more or much less than you think.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link